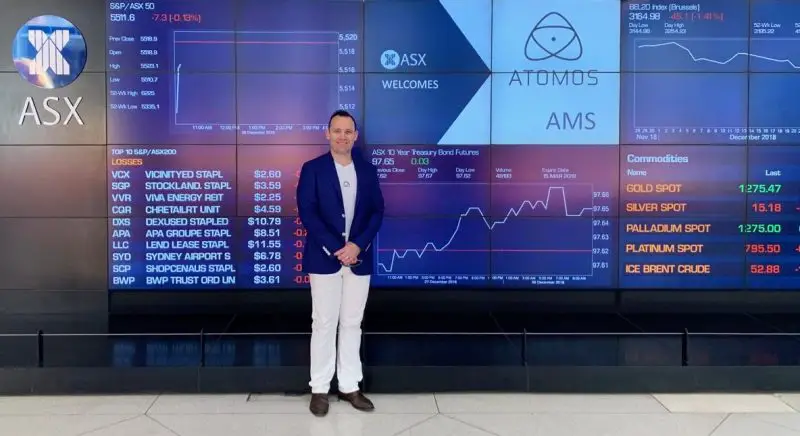

Atomos commences trading on the Australian Currency Exchange after completion of $6m IPO

Atomos Limited is now a public company trading on the Australian Securities Exchange (ASX:AMS). I am sure all of you are quite familiar with their market-leading, disruptive, and affordable recorder/monitors such as the Ninja V, Shogun Inferno and legacy models such as the original Ninja’s.

Now Atomos are levelling up in order to pursue innovation and further growth, which is said to result in lots of new products in the new two years. The Melbourne-based tech powerhouse was founded in 2010 and since then has established a strong sales network and international operations, with 74 employees across seven countries.

At the IPO issue price Atomos has a market capitalisation of $62.2 million, and projects around $42.2 million in sales in 2019.

Since commercialising the world’s first video monitor recorder incorporating Apple’s ProRes intermediate video format, Atomos has developed strategic relationships with key technology providers within the ecosystem including Apple, Adobe, Sony, Canon, Panasonic, Nikon & JVC Kenwood.

With the rapid growth in high-quality and accessible video content creation, Atomos is uniquely placed to take advantage of this growing global trend. Atomos has been dominating the monitor/recorder market for a few years now, and the new IPO will give the a huge boost to continue to innovate and bring out new products for indie filmmakers and content creators.

Image by Atomos

Going public with their IPO, Atomos is focused on expansion into the growing Social and Entertainment video content markets, as well as continuing to build upon its success in the Pro Video segment.

Atomos will use the funds from the IPO to support the Company’s global growth strategy, including expansion into adjacent growth segments of Social and Entertainment, as well as the launch and deployment of new products from its newly developed platform as showcased in the recently released Atomos Ninja V monitor/recorder.

After R&D investment of $39 million in this platform, Atomos intends to utilise this development and double its product range over the next 12-24 months.

Atomos CEO Jeromy Young, who co-founded the Company, said the IPO and ASX listing was a key step in continuing to grow Atomos presence in the burgeoning video content creation market.

“We’ve spent many years investing in silicon and software technology development to give Atomos an advanced offering with proprietary processing and trade secrets that underpin our product line,” he said.

“This technology, combined with our established brand and outstanding key relationships, place Atomos in an ideal position for continued growth. I’m extremely proud to be able to share the growth in value of the business with external investors as well as with the employees that are building the company together.”

What does this all mean to us, the indie filmmakers using Atomos monitor/recorders?

I think going public, from a strong, market dominating poll position, with a solid portfolio of top seller products is a sound business move. The fresh influx of funds will enable Atomos to accelerate their R&D efforts and allow them to bring out even more exciting new monitor/recorders and accessories for hybrid cameras and other acquisition devices in the near future.

I just hope they keep their “indie” spirit and continue to bring out very competitive products while still serving their customers (us) the ones that helped build the brand by buying the products, instead of solely focusing on making more money for their shareholders, which is what any public company, at its core, aims to do.

Disclaimer: As an Amazon Associate partner and participant in B&H and Adorama Affiliate programmes, we earn a small comission from each purchase made through the affiliate links listed above at no additional cost to you.